Table Of Content

Before you sign the contract, you already know what you’ll spend on the property at the end of the lease term. Most of the time, the purchase price is higher than the home’s current market value. This can be a good thing in real estate markets where prices rise reliably year over year, but it can also be risky. Rent-to-own purchases might also offer renters the option to lock in the home’s sale price while giving them time to build good credit and their down payment funds.

About Chase

You’ll negotiate the home’s purchase price with the seller and use an appraisal to determine how much the home is worth. You can let the agreement expire if you no longer want to buy the property, but you’ll likely lose your option fee and your rent credits. The purchase price of the home is locked in upfront to save any negotiation at the end of the lease. Rent payments will then include a rent premium, or the portion of monthly rent set aside in an escrow account to be applied toward the down payment.

Build-To-Rent Homes: A Renter’s And Investor’s Guide To A Hot Real Estate Trend

Many of the Airbnb icons will offer exclusive experiences to go along with the stay. Guests who stay in Prince’s Purple Rain house will be able to listen to rare and special from the musician; while a stay at the Ferrari Museum in Maranello, Italy includes a lap around a track with a professional driver. One experience will see a guest joining Kevin Hart for an evening at his members-only Coramino Live Lounge; and another includes a private living room performance from Doja Cat.

Other Products & Services:

Typically, a portion of the monthly rent you pay to the homeowner goes toward a down payment on the home. You have the option to use the accrued money, sometimes called rent credit, to buy the home at the end of your lease term. A rent-to-own home is a type of property that’s rented for a certain amount of time before it is eventually bought and owned by the renter.

Divvy gives you the power to start your homeownership journey now—and build wealth for yourself and your family—without perfect credit or piles of cash up front. Work towards improving your credit score with a program aimed at getting you mortgage-ready. You’ll have a personalized action plan to help keep you on track with weekly credit recommendations and financial tips built just for you.

Maintenance for your rent-to-own home

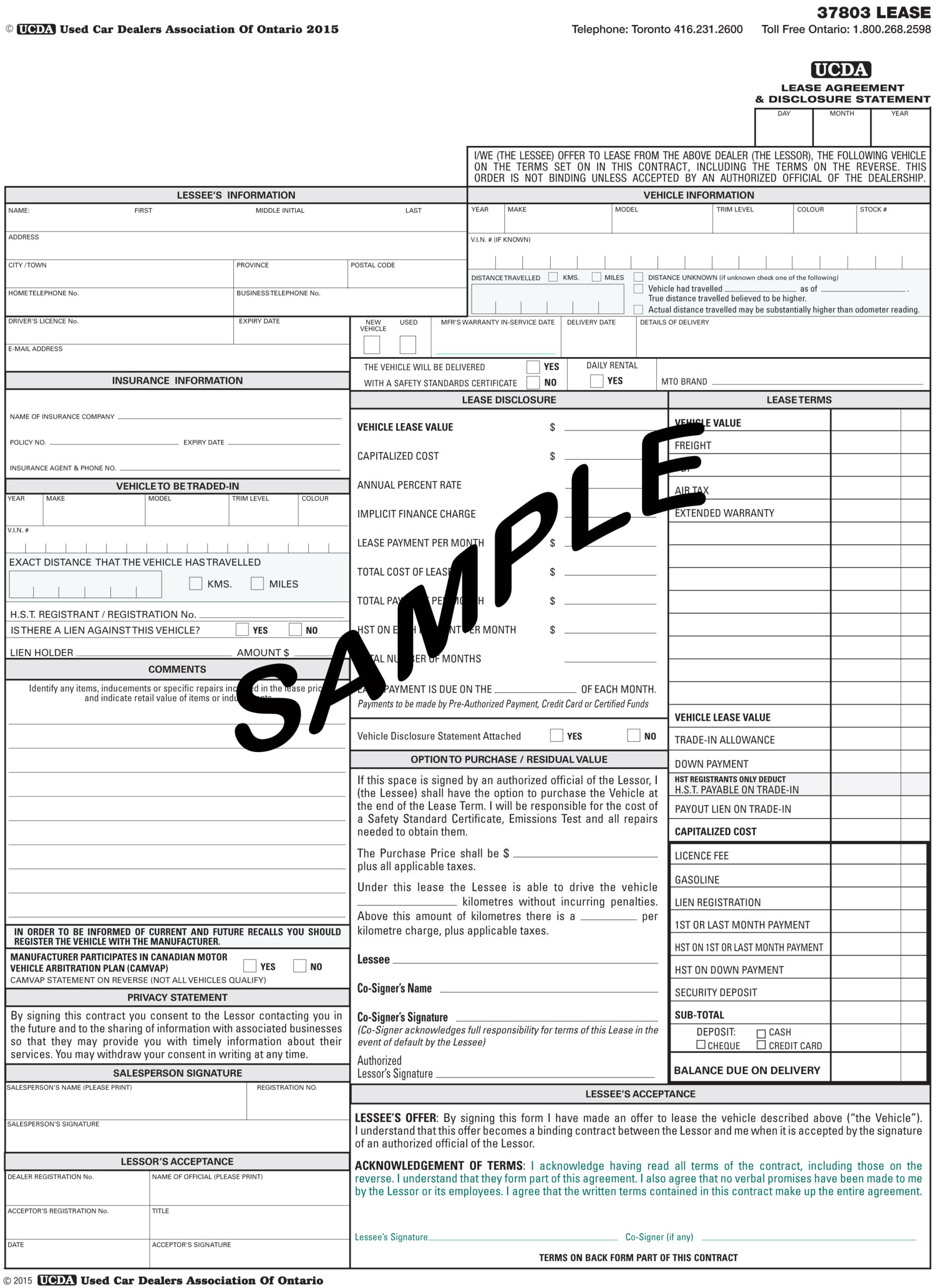

With strict automatic underwriting guidelines and 20% to 40% down-payment requirements, even financially capable people can have trouble obtaining financing in these markets. Watch out for lease-purchase contracts—you could be legally obligated to buy the home at the end of the lease, whether you can afford to or not. The key, though, is having a purchase plan in place before you sign a rent-to-own agreement. Both contracts allow you to lease a home for 1 – 3 years and then buy it at the end of the term.

Renting to own is basically a hybrid approach to buying a home where all or a portion of a lease payment goes to building equity in a home over time. It is usually a process by which the owner of a home allows a renter to build equity without having to make a down payment or secure a mortgage. Conversely, if you decide not to buy the house—or are unable to secure financing by the end of the lease term—the option expires and you move out of the home, just as if you were renting any other property. You’ll likely forfeit any money paid up to that point, including the option money and any rent credit earned, but you won’t be under any obligation to continue renting or to buy the home.

With Chase for Business you’ll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and managing payroll. Choose from business checking, business credit cards, merchant services or visit our business resource center. As with any home purchase, the condition of a home should always be considered before you sign on the dotted line.

Preapprovals are not available on all products and may expire after 90 days. There are various rent-to-own programs that can help people find a home. These programs have different qualifications and requirements (credit score, debt to income ratio, income, etc.) potential buyers will need to meet in order to get their application approved.

Gen Z Can't Afford the Rent - The New York Times

Gen Z Can't Afford the Rent.

Posted: Thu, 10 Aug 2023 07:00:00 GMT [source]

It's important to read the fine print on a rent-to-own agreement to understand whether it's lease-option or lease-purchase. Again, a lease-purchase agreement could put you in the position of being forced to buy the home, which may be problematic if you find later that you're unable to afford it or don't want to own it. “Anything unusual—in income, for example—tosses good income earners into an ‘outlier’ status because underwriters can’t fit them neatly into a box,” says Scholtz. “As home prices rise and more and more cities are priced out of conforming loan limits and pushed into jumbo loans, the problem shifts from consumers to the home finance industry,” says Scholtz.

Explore the home and go crazy for rare and special tracks from Prince’s world in an exclusive studio session. Each of the bedrooms is themed to different X-Men, with little details true to the character (Wolverine’s alarm clock has claw marks, for example). Speaking of South Carolina’s largest city, another major player is Charleston, S.C.-headquartered Greystar, which announced its entry into the BTR sector last year. The company’s dedicated BTR brand, Summerwell by Greystar, is expressly designed for people seeking a lifestyle going beyond apartments to single-family home communities.

Many rent-to-own contracts do not have extensive maintenance requirements, but some may. Renters could be required to cover the cost of replacing a roof for example or repairing other damages that can be large expenses. Most of the time when maintenance is needed, the renter cares for the lawn or other minor household tasks. Just be cautious of any agreement that requires you to take on a large financial burden. Renting to own can allow a person to begin building equity in a home they like without having to take out a mortgage or come up with a large down payment.

The option fee is typically one to five percent of the home’s purchase price, though there is no standard rate. Simply put, a rent-to-own home is a residential property that you agree to live in as a rental for a set number of years with the option to purchase the house at the end of the rental term. With most rent-to-own agreements, the renter pays an additional monthly payment that goes toward the down payment. The rent-to-own contract also includes the purchase price of the home. The tenant may also be responsible for specific maintenance or property upkeep. If you go with a lease option agreement, you’ll pay the option fee when you sign the contract.

Views and strategies described may not be appropriate for everyone and are not intended as specific advice/recommendation for any individual. Information has been obtained from sources believed to be reliable, but JPMorgan Chase & Co. or its affiliates and/or subsidiaries do not warrant its completeness or accuracy. You should carefully consider your needs and objectives before making any decisions and consult the appropriate professional(s).

No comments:

Post a Comment